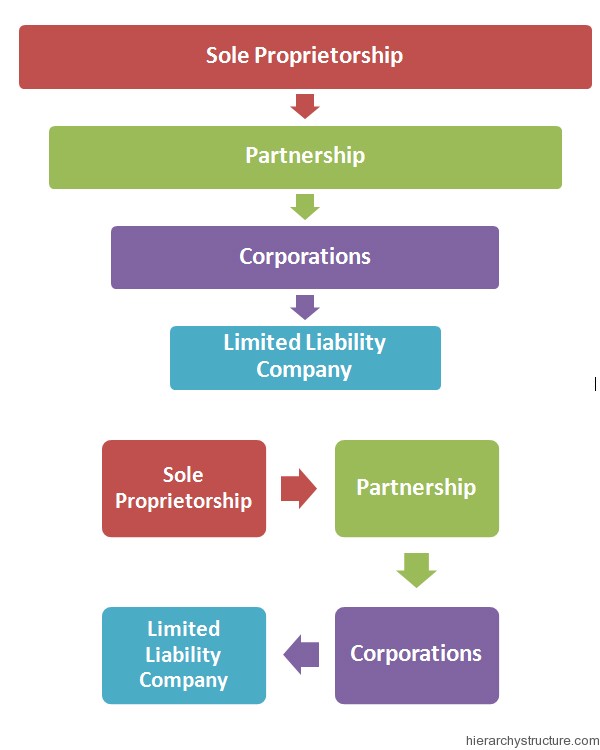

Corporate structure is simply the kind of relation an owner has with the business he owns. This structure is a legal bonding between the business and business owner and this determines the taxpaying scenario for that business.

It is quite vital to first arrange the business in a certain structure before start operating it to avoid the hassles thereafter. Hence, all the corporate structures are arranged in a covetous systematic hierarchy including proprietorship, corporations, partnership and limited liability companies. These are described briefly below:

Sole Proprietorship

This is the basic structure in the hierarchy. A sole proprietorship is simply termed as sole trader in the corporate sector. This is a type of corporate structure that is run and owned by only one individual. In such business entity there is not even a single distinction between the business and owner.

All the profit belongs to the single authority and so are loss and debt. In simple words, everything of the business including assets, income, debts and loss belong to the owner only. There are both advantages and disadvantages of this structure because if the profit is enjoyed by a single person then the losses are also bore by the same single person.

Partnership

Legally a partnership is an alliance of two or more people involved in a business to work ardently as co partners All the losses and profit are shared proportionally and equally. All the partners are considered co owners. The partnership is carried out according to the partnership act 101 (1994).

The biggest advantage of having a partnership is that it allows number of people to provide capital and hence share liability but the biggest disadvantage being the human nature of deceiving one another. Generally these people have a formal legal agreement between them to avoid any further dispute or problem in their partnership.

Corporations

The second last structure in the corporate structure hierarchy is corporation, an enterprise formed with the approval of the state government to carry on business activities that can be profitable as well as non-profitable. Such business structures are liable to issue shares of stock to raise funds which provides an assistance to increase its capital.

This is the most common and famous form of business organization and provided with many legal rights as an entity by the government. The process of becoming a corporation is termed as incorporation in the corporate sector.

Limited Liability Company

The last structure in the corporate structural hierarchy is limited liability company, a flexible and malleable form of organization that covetously blends the elements of corporate structure and partnership. It can be explained as a legal form of an organization which provides a limited liability to its owners.

But even this structure has got some disadvantages though advantages offered by this structure are very ardent and profitable. This is like a mixed hybrid entity having the traits of both a sole proprietorship or partnership (depends on the number of owners) and a corporation.