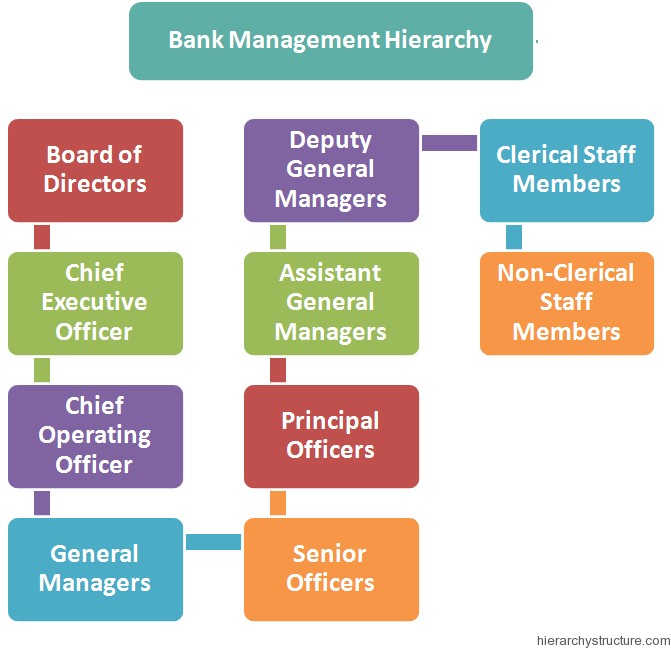

The banks need a proper organizational hierarchy in order to carry out all the activities of the organization in a smooth and the most efficient way.

A bank management hierarchy typically enlists all the job titles from top to bottom in order of their importance, experience levels and contribution towards the organization. The hierarchy plays a vital role in the effective functioning of the bank by ensuring a proper communication channel between the different levels of the professionals. Here is the detailed hierarchy that is prevalent in most of the banks.

- Board of Directors

- Chief Executive Officer

- Chief Operating Officer

- General Managers

- Deputy General Managers

- Assistant General Managers

- Principal Officers

- Senior Officers/Probationary Officers

- Clerical Staff Members

- Non-Clerical Staff Members

Board of Directors

The main job role of the Board of Directors is to protect the interest of the shareholders. They establish various compensation committees and review the financial statements of the bank at regular intervals of time.

Chief Executive Officer

The chief executive officer is responsible for enacting the operations and policies. The CEO reports to the Board of Directors regarding the various financial data.

Chief Operating Officer

The chief operating officer analyses the market constraints, and set forth new business initiatives and plans in order to increase the quality of operations of the bank. The COO manages all the regulatory issues and issues related to the operations and public relations.

General Managers

The general manager manages the bank staffs and assigns specific tasks to them. S/he prepares the regular work schedules and coordinates various financial activities.

Deputy General Managers

The deputy general manager assists the general manager in several of the duties. They review the various budget activities along with the general managers.

Assistant General Managers

The assistant general managers act as a communication line between the principal officers and the general managers. They take part in the various administrative activities.

Principal Officers

The principal officers form an important rank in the bank management hierarchy. They perform various targeted functions like negotiating new transactions, rescheduling and restructuring of the portfolios. They develop new financial structures according to the emerging needs of the bank. Moreover, they lead and manage the junior staff members and develop professional relationship with the various clients.

Senior Officers/Probationary Officers

The senior officers are responsible for meeting the monthly sales targets assigned to them by the executive officers of the bank. They evaluate the sales prospects in the particular geographical area assigned to them and coordinate with the internal and the external teams.

Clerical Staff Members

Clerical staffs of the bank are also referred to as tellers. The staffs manage the cash deposit and the withdrawals. They pay and receive money from the customers by evaluating their authentic signatures.

Non-Clerical Staff Members

The non-clerical staff members are also called as office assistants and they are at the bottom of the bank management hierarchy. They perform duties like filing and record keeping of bank’s record, attending the visitors, and delivering various documents of the bank.