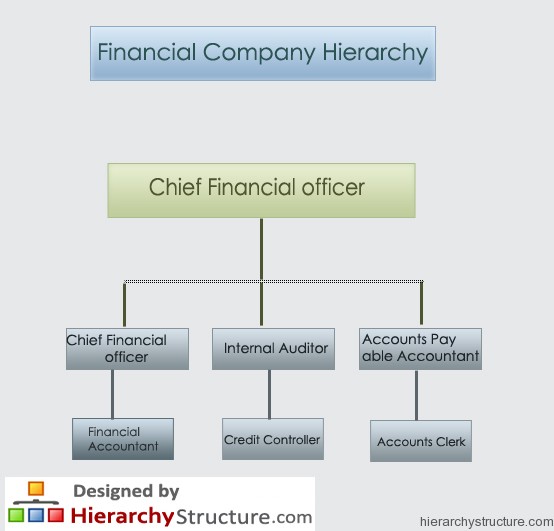

The financial company hierarchy is an illustration of the segregate sections which run the departments pertaining to finance and hold the authorities, responsibilities and power of the different individuals of the employees of these financial departments. This hierarchy includes the specific arrangements of employees based on their job function, power and status in the organization. Every company’s individual hierarchy varies from every other company but the basic organization and structure remains the same.

These hierarchies showcase their effect on employees, financial career path and also impact the culture within the corporate organization. These hierarchies are generally vertical in nature and the power goes from downward to upward levels, while the responsibilities are quite evenly spread across the organization.

Following are the different levels in the hierarchy:

Chief Financial officer

The Chief Financial Officer is the top most designation in the financial company hierarchy and the professional at this designation serves as the overall head of all the finance related activities and departments in the organization. A CFO is required to coordinate the entire activities of the finance department and is also required to work closely with the departmental heads of the sub departments in order to achieve performance objectives for the organization.

Management Accountant

The management accountant serves as the head of the accounting sub department and is offered the second senior most position in the financial company hierarchy. A management accountant is required to provide accurate, useful and timely information which makes the top management to take the wise and informed decisions pertaining to the current and future business activities of the organization.

Financial Accountant

A financial accountant is required to report to the CFO and is also responsible for providing required financial information in the timely manner in order to support the informed decision making process by the senior officials of the organization. A financial accountant is also responsible for analyzing, interpreting and preparing the financial reports on periodic basis.

Internal Auditor

An internal auditor is a professional who reports to management accountant and is responsible for regular analysis of overall financial transactions of the organization in order to ensure that there are adequate controls and capability in safeguarding the expenditures, accounts and revenues of the business.

Credit Controller

A credit controller is a professional who reports to the management accountant and is majorly responsible for managing the receivable accounts of the organization which includes outstanding debts and cash payments. A credit controller is required to ensure that all the invoices are being prepared and sent out in the timely manner and also for developing time to time listings of agent debtors for tracking the outstanding amounts.

Accounts Payable Accountant

An accounts payable accountant also reports to management accountant and is majorly in charge of payable accounts sub department. This professional is responsible for making and processing the required cash purchases and payments as soon as they become due.

Accounts Clerk

This is the junior most level in the financial company hierarchy and these professionals are present in all the financial departments and report to their respective heads.