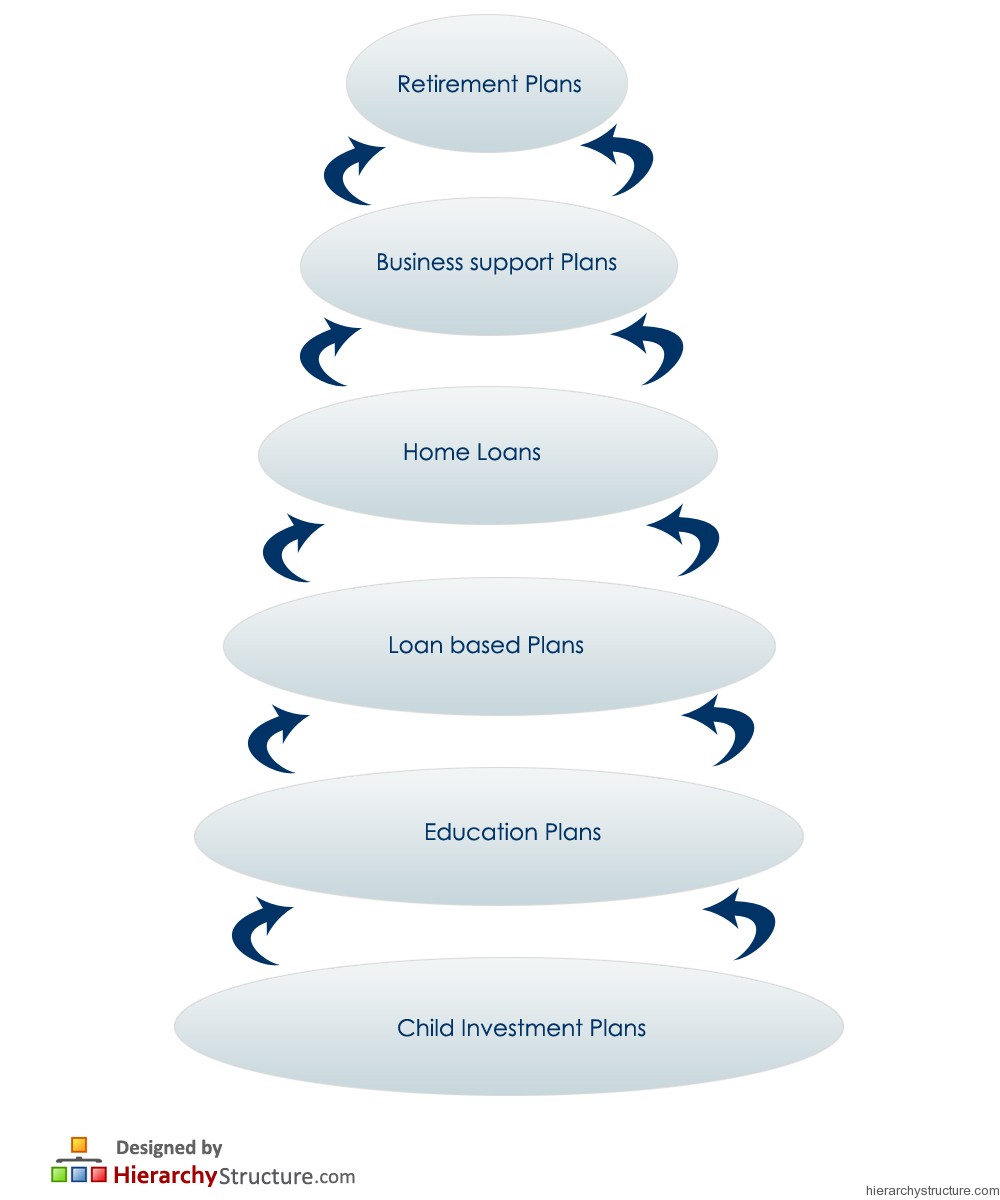

Finding your way in between several financial products that are available in the market can be quite confusing if you are not familiar with any of these products. Following is the financial product hierarchy which provides you with the details of different financial products that are available and can be useful in different stages of life. This hierarchy takes you through the major events in the life of an individual right from the birth and highlights the specific financial products that might be useful at that particular stage of life.

Child Investment Plans

There are various types of policies that are available for new born babies and the investment that you make with such plans grows with the baby in order to support the specific financial needs of your child. These plans support the child’s needs for three major aspects – education support, financial career planning and abroad education.

Education Plans

The second level in the financial product hierarchy is for supporting their education. Providing high class education to the students in state of the art institutions can be quite expensive and if you have not worked out for any provision to manage these expenses, the cost may be crippling, especially if you have more than one child.

Loan based Plans

Once you complete your education, there are various aspects that may require a great deal of money like buying car, buying your home, starting your business or any other initiative. To support any such aspirations for you so that you can make a timely purchase or start a business in time without hassling around for money. You can opt for various loans with flexible options with which you can repay the loan.

Home Loans

For most of the people, the first home is always special but to purchase the same you need a great deal of money. At this stage again there are financial products which offer home loans so that you can buy one for yourself. There are many flexible with which you can set the repayment mechanisms and the range of rate of interest as per your custom suitability.

Business support Plans

Whether you have a small business or a limited company, there are many more things that you require to consider apart from the account books. For example protection and insurance based products for your employees. At this stage you can indulge in taking company based saving, provident funds, medical insurance, pension schemes etc.

Retirement Plans

To plan your retirement, you need to take the last set of products in the financial product hierarchy that give financial stability even after retirement. These are the pension plans. An ideal pension plan is the one that has been tailored as per your basic requirements, how much can you afford at a particular time for investment and what kind of returns are you looking for. These plans give financial independence at the later stage of life when you are not in a position to work and earn money.